Market Trends

Check Home values in your area over 12 months.

Unlock Local Market Trends

Filters Reset

Save Snapshot

View Results

MARKET SNAPSHOT

(DEC 16, 2025 - JAN 15, 2026)

MARKET SNAPSHOT

?

Sold Listings

?

Average Sales Price

?

Average Days on Market

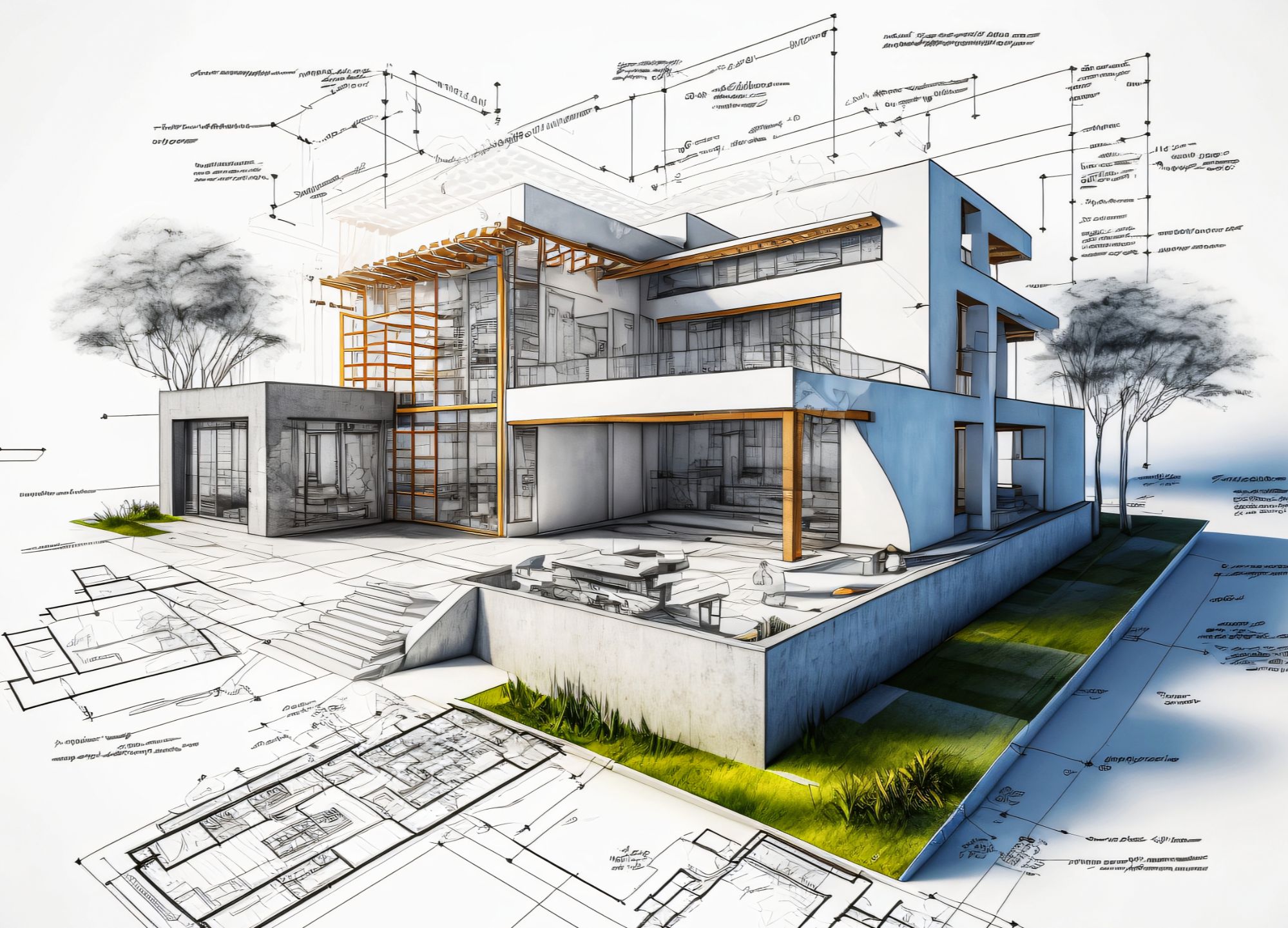

During this initial appointment you can plan on discussing your new construction project in detail. We discuss in detail your time frame and overall project goals. You will leave our appointment with a clear concept of what our broker / builder relationship will look like as we move forward in the process.

"Vision is the art of seeing what is invisible to others."

FLOOR PLAN & DESIGN CONSULTING

PRICING & DEMOGRAPHIC ANALYSIS

BUDGET ANALYSIS

PROJECT CO-MANAGEMENT

CREATIVE PRE-CONSTRUCTION MARKETING

CUSTOMIZED LISTING MARKETING

LENDER PARTNERSHIPS

VENDOR RELATIONSHIPS

TRANSACTION MANAGEMENT

RELATIONSHIPS WITH LONGEVITY IN MIND

REAL ESTATE SERVICES

Driven by a deep passion for real estate, my focus is your success. Together, we'll turn your real estate goals into reality, with guidance tailored to your unique needs.

SELLER SERVICES

VIDEOS

Check out our video resources to learn more about the buying and selling process

Filters Reset

Save Search

0 Properties